The Headline of the Week

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in December on a seasonally adjusted basis . . . .U.S. Bureau of Labor Statistics, December Consumer Price Index Press Release

- The CPI has not shown a decline month-to-month since the early days of the Covid-19 pandemic.

- The annualized, but not seasonally adjusted, CPI came in at 6.5%, down nearly 2.5 percentage points from the June 2022 high.

- The steep drop in gasoline prices contributed most of the decline, as food and shelter prices continued to rise.

- The so-called “core” CPI, which excludes food and energy, climbed 0.3% from November, but the annualized rate was down to 5.7% from 6.0%.

- The news was not entirely rosy. The rent component of CPI rose 0.8% to bring the annualized rate to 7.5%, a level not seen since the 1980s.

Home Sales, Starts, and Financing

- The week ended with the 30-year mortgage rate only seven one-hundredths of a point over 6.00% and down over a full percentage point from the high in October 2022.

- On a $360,000 mortgage, the monthly payment is $269 lower at 6.07% than at the 7.20% of October 31, 2022 — a savings of over 11%.

- What drove down the mortgage rate (and the 10-year U.S. Treasury Note)? The Headline of the Week.

- The housing sales and inventory data for December 2022 have begun to flow. Calculated Risk summarized a first glimpse at the last month of the year.

- Inventory was up 76% from December 2021 after starting the year in January 2022 down 30% from the prior January. Month-to-month, inventory was down in every one of the 40 markets tracked by CR.

- New listings were down over 21% after posting an 18% decline in November. Santa Clara and San Diego led the decliners both dropping over 40%.

- Closings were down more than 37% year-over-year on par with November. Las Vegas led the slide downward with a drop of over 50%.

- Looking at the shape of inventory volume month-to-month in each of the last several years reveals that 2022 was unusual but not for the way the number of listings changed at the end of the year. That portion of the curve appears normal.

- The year 2022 was unusual for the abnormally low inventory from January to July.

- The year also stands out for the consistently low inventory volume compared to 2017 to 2019.

- Wells Fargo Bank announced the closure of its correspondent mortgage business, which apparently began in retrospect in 2023 Q4. The bank once had sought to become the largest player in the correspondent segment of mortgage lending.

- One of the largest banks in the U.S., Wells Fargo joins other large banks that have left correspondent lending — Bank of America, Citibank, Chase Bank, and CapitalOne.

- The Fannie Mae Home Purchase Sentiment Index for December measured a small rise in buyer sentiment about purchasing a home.

- Buyer optimism about mortgage rates, buying conditions, and job security contributed to the rise in the Index.

- The HPSI bottomed in October, and the December value is the highest since August 2022.

- An interesting irony in the index data appears when comparing December 2021 (a month of strength for sellers and high demand among buyers) to December 2022 (a month of weakness for sellers but low demand with buyers).

- The HPSI was 21.6% higher in December, but . . .

- The “Good Time to Buy Measure” of the Index was at 26% in December 2021 and 21% in December 2022.

- The “Bad Time to Buy Measure” was at 66% in December 2021 and 76% the following year.

- Buyer sentiment really has not changed all that much over the past year, but the media assessment and public perception of the housing market has deteriorated dramatically.

- So, when sellers are getting historically high prices and buyers are paying those prices because of low interest rates, the market is great. When prices are still high but interest rates obstruct buyers from paying high prices, the market is bad. Make sense? Not really.

- With so much negative news about the for-sale housing market, muttering is expected about foreclosure risk and a recurrence of the 2009-2012 foreclosure wave. The data should silence the muttering, at least through the end of 2022.

- According to ATTOM, the end of the CARES Act forbearance programs allowed foreclosure filings to rise by more than 100% over the 2021 volume, but the total for 2022 of 324,237 still was below the 2019 pre-pandemic volume.

- By comparison to 2010, the volume is down 89%.

- 2022-2023 will not repeat the Great Recession foreclosure experience. That’s not a forecast. That’s a fact as certain as the passing of time. So, let’s talk about the opportunities that likely will arise when the modest current slowdown reverses, which also is certain to occur and only uncertain as to timing.

Construction Costs and Supply Chain

- We reported last week on the strong employment performance of the U.S. economy in December with unemployment falling to 3.5%. A closer look at the data from the National Association of Home Builders revealed the contribution of residential employment to the job gains.

- Residential construction employers added 9,500 jobs in December, bringing the total of those jobs to an almost three-year high.

- The total number of people looking for work also increased slightly in December, making the job gains number a bit more impressive.

- Moderating the unhappiness that strong employment causes for Federal Reserve bankers, wage gains slowed in December and the rate of job growth also declined.

- Lumber eased slightly during the week, but copper spiked significantly, up 12.4% since the beginning of the year.

Residential Leasing

- Growth in the single-family rental market is no secret. Institutional investors and publicly traded REITs have been driving the single-family rental industry for more than 10 years. With the downturn in single-family sales, however, many builders and investors are suddenly interested in the SFR opportunity.

- In 2022, new SFR properties surged by 20%.

- At the end of 2022, some of the largest players in SFR pressed pause on new acquisitions, while other players announced entry into the market. The net impact was a 40%+ increase in SFR starts in 2022 Q4, but a significant decline in single-family investor purchases.

- An early retrospective on multi-family demand in 2022 is a tale of two halves. RealPage released its initial assessment of the apartment market for 2022 and reports (based on a sample size of over 9,000,000 units):

- Over the year, inventory rose 345,000 units, but demand fell by 103,000 with most of the demand downturn among new tenants.

- Median rent declined in 2022 Q4 but rose over the year at a higher than historically normal 6.6%.

- Three of the top five markets for rent growth were in Florida (Miami, Ft. Lauderdale, and Orlando) but for occupancy none of these markets were in the top five.

- Moody’s Analytics concurs that the multi-family marketing is softening a bit.

- Vacancies rose in more than twice as many metros in 2023 Q4 than in Q3, representing just a bit less than 50% of the metros tracked by Moody’s.

- Median rent declined in roughly 20% of the tracked markets with annualized declines of more than 20% in Palm Beach, Atlanta, San Bernardino / Riverside, Memphis, and Baltimore, leaving Memphis down 0.7% and Baltimore, Little Rock, San Antonio, and Washington (DC) up less than the annual norm of approximately 4% for the year

- The strongest rental rate markets for the year were Knoxville, Seattle, Charleston, Chattanooga, and Los Angeles.

- ApartmentList reported this week on the Raleigh market.

- Median rent declined 0.9% in December to end the year up 5.2%, compared to a 6.2% increase state-wide.

- For December, Raleigh fell squarely in the middle of the top 100 markets nationwide, and the city sits in nearly the same position on the nationwide scale of rent dollar amount.

- In the Raleigh metro, Apex and Morrisville had higher rents than the City of Raleigh.

- The 2022 rent rate increase in Raleigh beat 2020’s 1.8% and 2019’s 3.0% but was far below the very unusual 2021 pace of 20.5%.

Other News and Data

- We’ve been talking about the diversity of data sources available regarding the housing industry. U-Haul International joins the community of surveys and reports with its annual summary of one-way truck rental data.

- In 2022, Texas, Florida, and the Carolinas settled at the top of the list of one-way rental destinations. Other top-ten inbound states included Virginia, Tennessee, Arizona, Georgia, Ohio, and Idaho.

- California, Illinois, and New York ranked highest for outbound one-way rentals. Other net losers of migration were Michigan, Massachusetts, New Jersey, Maryland, Arkansas, Oklahoma, and Alaska.

- Keep in mind the source of this data. U-Haul customers have a demographic, as do all customers. The demographic provides important information about how to interpret the U-Haul data.

- Another new entrant to the data marketplace is the employment listing site Indeed.com with its Wage Tracker. In December, the median of wages for all posted job openings on Indeed.com rose 6.3% from December 2021.

- The pace of wage growth has slowed for the past 9 months.

- Wage growth is decelerating most quickly in the lowest wage categories of jobs, such as childcare and food preparation.

- Initial unemployment benefits claims were a modest 205,000 in the week ending January 7, reported the U.S. Department of Labor. The 4-week moving average was 212,500.

- In 2022, the lowest reading was 170,500 in early April and the highest level was in early August at 249,500.

- The moving average has declined each week since early December.

- A positive sign for slowing inflation emerged from the National Federation of Independent Businesses survey of members in December, reporting a decline in the number of small businesses that raised prices in December.

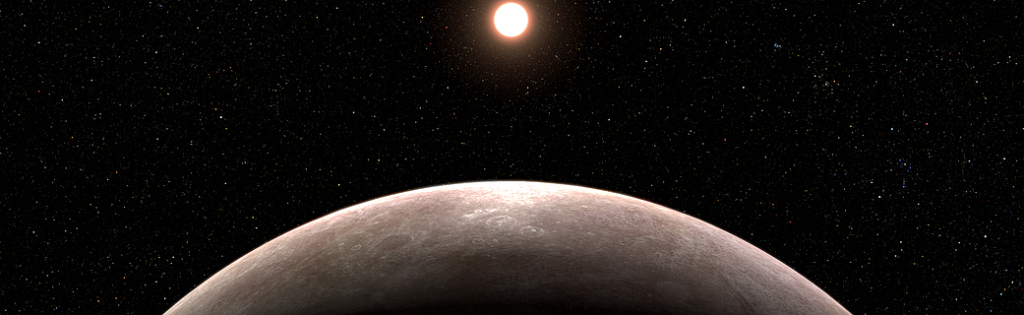

If You Want to Be a Pioneer . . .

Consider investing in real estate on the untouched planet LHS 475 b, detected in August last year by the James Webb telescope. The planet is nearly identical in size to Earth and only 41 light years away. We suggest only a letter-of-intent at this point and avoiding any significant diligence expense, however. Scientists don’t yet know whether the newly discovered planet has a hospitable atmosphere but suspect that the surface temperature is hundreds of degrees hotter than Earth. The planet’s year only lasts two days too, which may confuse rent and mortgage calculators.