2023 February 17

Investor home purchases have plummeted. They have the cash but are on the sidelines watching prices decline. Will prices fall enough to have made the waiting worthwhile?

Investor home purchases have plummeted. They have the cash but are on the sidelines watching prices decline. Will prices fall enough to have made the waiting worthwhile?

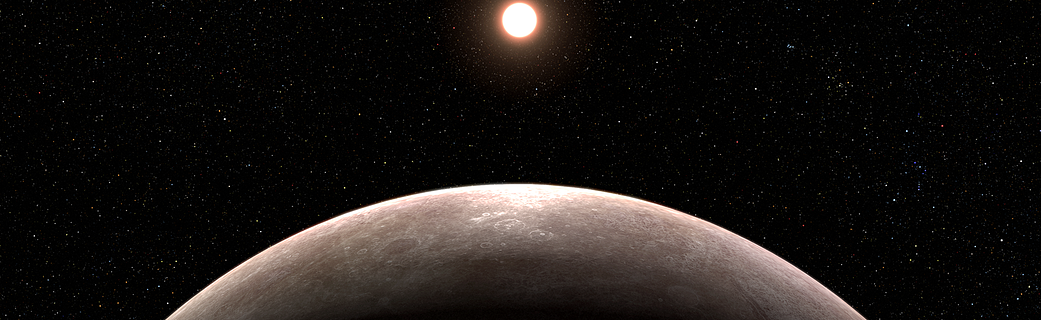

Lots of data this week on single-family lot supply, multi-family permitting volume, and the formation of stars in distant galaxies.

The new jobs number startled economists, analysts, investors, and most importantly, the Federal Reserve Bank with an actual increase more than twice the consensus forecast.

Lumber prices spiked in the second week of January despite a slow and still slowing housing market. Suppliers have down-sized dramatically and are anticipating at least a modest recovery as mortgage rates slowly fall.

Inflation seems to be slowing, but housing costs are outpacing price increases in other goods and services. Rents are declining. For-sale inventory is rising because of slowing sales.

The Internet begat real estate technology firms hoping to compete with the traditional brokerage industry. One avenue for competition is the gathering and analysis of housing data. We now have multiple sources of data but also uncertainty and often disagreement.

New research and thinking about residential rent inflation reveals a more accurate methodology for better measuring the current rental rate direction and velocity.

The 30-year mortgage rate dropped 30 basis points on January 6, 2023 perhaps based on optimism from data showing a deceleration in hourly wage growth.

Ringing out the year in housing with a fact and a forecast. The housing market is “down” relative to an extraordinary up. We predict another up albeit less extraordinary.

The Fed raised its Federal Funds rate by 0.5%, pushing the rate to between 4.25% and 4.5%. Investors were pleased.

PO Box 97666

Raleigh, North Carolina 27624

(919) 263-0960

© 2024 All Rights Reserved.