Our recap of the week in numbers from equities to bonds to commodities and housing to the many indices and measures of the economy and the for-sale and rental housing markets.

It’s not going to be a short and shallow recession; it’s going to be severe, long, and ugly.

Nouriel Roubini in an interview with Fortune Magazine

Professor Roubini has made a career out of pessimism. Like all of us, he’s been correct and incorrect throughout his career. Perhaps we would be best served by a reminder about predictions:

Prediction is very difficult, especially if it’s about the future.

Niels Bohr (1922 Physics Nobel Prize)

Equities and Bonds

- From Nouriel Roubini, the usual trumpeting of his correct predictions with a dour forecast of a hard and long landing for the stock and bond markets and the economy as soon as the end of 2022. He argues:

- Central banks will yield in the battle against inflation when economies fall into recession.

- Much of the inflation problem is not in consumer demand but in ongoing supply chain constraints.

- The 10-year treasury started and ended the week around 3.8% despite trading below 3.6% early Tuesday morning. During the week, mortgage rates ignored the 10-year and climbed 35 basis points by the end of the day Thursday to over 7% again, based on Mortgage News Daily data.

Home Sales and Starts

- Is the problem facing home buyers rising interest rates or an extraordinarily long period of zero interest rates? All one need do is look at this chart.In April 1971, the interest rate on a 30-year mortgage was above 7%.

- The rate did not drop below 7% until 1993.

- The 30-year rate did not get to 6.5% until 2001.

- Between then and 2008, the rate did not get below 5.75%.

- Enter the Great Recession when rates dropped to 3.4% by May 2013.

- The 30-year mortgage interest rate remained below 5% until April 2022.

- An entire generation of Americans believes that mortgage interest rates should be below 5%. These are the first-time home buyers. These are the people forming new households. Ten years of unusually low interest rates created a generation of Americans with unfounded expectations for new home affordability.

- Realtor.com released its monthly for-sale housing inventory data for September.

- A 23.7% drop in pending listings offset a 26.9% increase in active listings to leave total inventory only slightly higher. The flat inventory number disguises the significant decline in newly signed contracts.

- New listings declined 9.8%. Some would-be sellers are waiting while others have become landlords.

- Prices were still 13.9% higher than in September 2021, but the percentage increase is declining each month since the Spring of 2022.

- Active listings are aging 50 days before going under contract, which is 16.3% longer than the same month last year. Before the pandemic, the average days-on-market was 68.

- Fortune magazine collected the home price forecasts from four well-known analysts. The common view is no surprise. Home prices will fall to offset partially rising mortgage interest rates and partially the meteoric rice in prices during the Covid-19 pandemic.

- Morgan Stanley forecasts a 7% decline in home prices by December 2023, which would be second only to the 27% decline from 2006 to 2012. MS notes, however, that such a decline would only bring home prices down to the January 2022 level, which was still 32% above March 2020. A 7% “correction” would do little to ameliorate affordability, and most sellers likely would take comfort in a 32% increase over roughly three years.

- Goldman Sachs offers less detail but forecasts a home price decline of 5% to 10% by year-end 2023.

- Moody’s prediction is in line with the 5% to 10% anticipated by GS with the potential for a 15% decline by the end of 2023 if the U.S. slips into a recession or mortgage interest rates don’t start dropping by Spring 2023. Moody’s highlights the price risk as greatest in markets that saw the steepest increase. No surprise there, but keep in mind that these are the markets where Americans want to live largely in the most vibrant urban areas, peaceful retirement destinations and more generally in the West, Southwest, and South. Unless Americans change their living preferences dramatically, these markets will be resilient over the long-term with short-term price corrections as prospective buyers pause to await lower mortgage rates. Data from May 2022 to August 2022 show that few markets outside of the West (notably Austin and Raleigh) saw a price decline.

- Fitch Ratings is slightly more pessimistic with a longer time horizon of declining prices over two years.

- For a fascinating and enlightening history of home prices, we commend this article from Better.

- Real estate has become like baseball, an abundance of statistics with sometimes unclear and often conflicting meaning. The data for the week:

- The Freddie Mac Primary Market Mortgage Survey measured the 30-year interest rate at a devilish 6.66%, slightly below the prior week.

- The same day, Mortgage News Daily‘s survey found the average rate to be 6.95%. Freddie Mac’s survey is one week behind current data. MND gathers current rate data each day.

- Sentrilock showing data for August 2022 showed a significant 14% year-over-year decline in home showings. The nationwide number masks a whopping 56% decline in the Northeast but only a 1% decline in the South. The number of showings per property declined 18%.

- The Black Knight Mortgage Monitor for August 2022 showed that home prices are dropping at the fastest pace since January 2009. Month-to-month from July to August home prices were down about 1% nationwide. The San Francisco Bay Area led the drop at 10% with other markets in the West close behind but several hot markets farther east (Austin, Minneapolis, Raleigh, and Nashville) were down 3% or more.

- Magnifying the median price decline, price-per-square-foot data show a decline of 4% from May to August 2022.

- Even with these substantial declines, home prices in many metros are 15% or more above one year ago, including Miami, Tampa, Orlando, and Dallas (all 20% or more higher) and Jacksonville (FL), Nashville, Raleigh, and Charlotte (all 17% or more higher).

- Of the ten least affordable markets in the U.S. only New York City and Miami are west of Las Vegas and six are in California.

- Month-to-month inventory was nearly flat from July to August but still remained 600,000 units below the pre-pandemic level.

- Mortgage delinquencies are at a record low and far below the delinquency rate from 2007 to 2014.

- Mortgage rate locks on purchases (i.e., not refis) were down one-third from last year and about one-half from 2020.

- Still, echoing the PPG September 30 weekly data summary, the Black Knight data show that the monthly payment for a median-priced house at a 6.29% mortgage interest rate is now up 66% from a year ago — an eye-popping $840. The gap is wider now that interest rates have climbed above 6.6%.

- Census Bureau data showed private residential construction spending at $912.9 billion in August 2022 slightly below the the July number and almost 10% above August 2021. Residential builders likely are completing contracts written months ago for housing construction.

- While researching this week’s post, we stumbled across a June 2022 paper from the Board of Governors of the Federal Reserve. Unless you adore mathematics, following the link to the paper will be mind-numbing. The paper concludes that the housing demand boom during the Covid-19 pandemic could have been satisfied by not less than a 30% increase monthly in new for-sale listings of homes.

Residential Rents

- The week was quiet for news about the residential rental market. Do not worry, we are paying attention.

Construction Costs and Supply Chain

- Lumber prices spiked this week. As of Thursday, the price for 1,000 board-feet was $460 — a rise of 12% for the week.

- Fuel costs also rose after OPEC+ announced a 2,000,000 barrel-per-day cut in production targets. Oil rose more than 8% and gasoline rose more than 12%. Fuel costs are a significant component of horizontal land development expenses.

Other News and Data

- Job openings were down more than 6% at the end of August reports the U.S. Department of Labor. Given the weakening economy, the decline seems sensible. Nonetheless, employers reported 10.1 million jobs available, still nearly two jobs for each American seeking employment.

- ADP reported that private employers added 208,000 jobs in August 2022 up from July and higher than forecast by 8,000.

- Wages also rose by 7.8% from the prior August beating the July annual increase by 0.1%.

- According to the Bureau of Labor Statistics, unemployment declined in August 2022 from the prior year in every “large” metropolitan area.

- On the other hand, the Department of Labor reported a steep rise in initial unemployment claims for the last week of September. Good news for inflation, but bad news for the economy.

- Friday Update: The Bureau of Labor statistics data report for September employment showed that non-farm employers added 263,000 new jobs in the month, helping (along with a reduction in the number of people looking for work) to drive the unemployment rate down to 3.5%.

- The total number of unemployed people declined to 5.8 million — roughly 57% of the number of job openings reported earlier in the week by the U.S. Department of Labor.

- While the number of new jobs in September was substantially below the average for 2022, it was above the pre-pandemic average. Despite rising interest rates, employers are still hiring at an expansionary pace.

- Jobs are plentiful. The economy seems strong. The stock market opened sharply lower. Investors were incorrigibly spoiled by the Federal Reserve’s easy monetary policy.

- Friday Update: Despite solid employment data, some evidence has begun to appear that employers are becoming less enthusiastic about hiring. One recruiting firm reported a significant reduction in the number of jobs available in September 2022 in industries particularly sensitive to interest rates. The overall decline in available jobs is small, but the change from September 2021 was large.

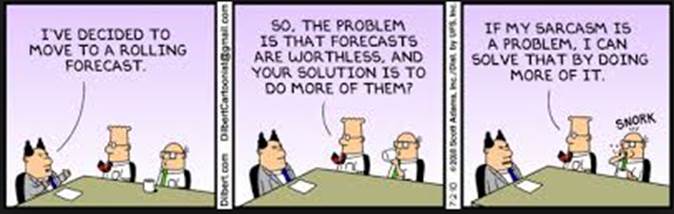

And because worries about the future abound when the economy is unstable or in decline, we offer a practical and humorous end to this week’s post.

Never let the future disturb you. You will meet it, if you have to, with the same weapons of reason which today arm you against the present.

Marcus Aurelius on Twitter (just kidding)

And finally, the brilliant Dilbert: